Hemp Business Loan Options

You know how to grow. We can help you scale.

Consistent cash flow is key during cultivation cycles.

FundCanna will work with your customers to ensure your invoices are paid on time.

You’re a savvy entrepreneur. You dot all the i’s. You cross all the t’s. You do due diligence. You’re a rule follower, and since hemp is legal on a federal level, and state law allows you to grow and manufacture CBD products, you’d think it’d be easy to get the small business loans you need.

But while it’s easier for CBD businesses to get SBA loans than cannabis companies, it’s not exactly easy to get a business line of credit. Even if you have a perfect credit score. There just aren’t a lot of viable lenders who understand the ins and outs of the cannabis industry, and don’t offer the business financing options you need. That’s where we come in.

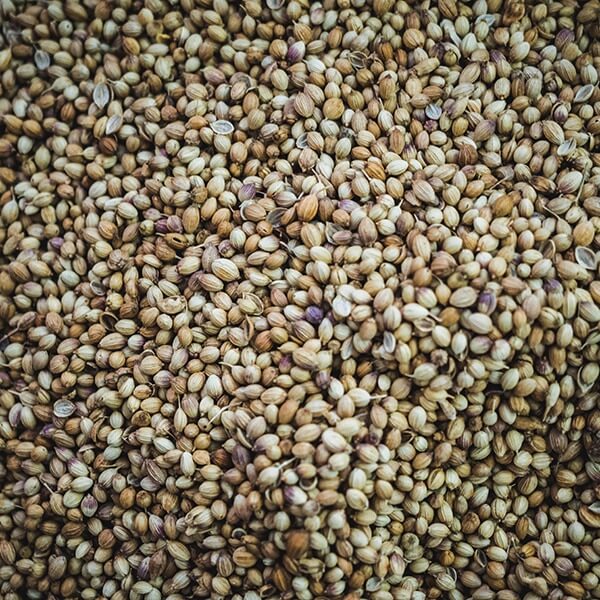

FundCanna can help you get the resources you need to grow your business. Whether you want to purchase more biomass, land for growing, or invest in equipment for your manufacturing facility, we offer a range of financing options for business owners like you.

FundCanna can help you get the resources you need to grow your business. Whether you want to purchase more biomass, land for growing, or invest in equipment for your manufacturing facility, we offer a range of financing options for business owners like you.

Applying for a loan for your hemp business has never been easier.

Fill out the form below and have access to the capital you need in as little as 24 hours.

Get access to the funding your Cannabis Business needs. FAST

Viability Key To Obtaining A Hemp Business Loan

Scaling in the nascent hemp space comes with a reasonable degree of risk. Waves of brands are vying for local, national and global viability. Most, if not all, of those operators are racing to scale.

Successful hemp businesses often scale through various financing options, providing them with the needed capital.

Obtaining a hemp loan requires a bit more work than traditional industries despite the passage of the 2018 Farm Bill. However, following a business plan and working with a suitable lending partner makes the process as smooth as possible.

Finding and obtaining the correct hemp business financing option for your company starts in-house. You can spend all the time researching the best hemp business loans and other options, but without the credentials, lenders won't approve your application.

Showing viability as a business boils down to a few critical components:

- Establish a business model: Demonstrate that the company is on a sound structure and good direction.

- Detail your target market: Who is your average consumer? Detail whom you plan to attract.

- Layout your corporate structure: List all existing capital streams financing the operation in your application and be prepared to elaborate on each.

Established and startup companies alike should follow this plan. Existing ventures may need to hone in on restructuring plans as well. In either case, demonstrating that your company is on a sound footing is key to obtaining a hemp loan or any other cannabis financing solution.

Establish The Proper Team And Culture

Companies rarely succeed in the long term without a fitting company culture in place. Demonstrating your company values, team cohesion, and results will be critical in successfully obtaining a hemp loan.

New and existing companies may struggle with this seemingly straightforward concept. With the workforce culture changing and a post-pandemic workplace transforming how teams operate, finding the ideal team is more complicated than ever.

But with an open-minded, diligent leadership team, highlighted by staffing and HR professionals up to date on the latest regulations and hiring practices, any company can thrive. Align company core values with each position--every role matters. Ask how their experience and work philosophy line up with the current team and your company pillars.

In a way, growing your team culture is much like cultivating a cannabis plant. Apply the same level of care to each. This crucial step will take time and requires constant cultivation. Even a strong team can crumble if neglected or overlooked.

Using Your Hemp Business Loan To Scale

Capital access is critical for any business, especially in the nascent hemp marketplace or cannabis in general. Hemp business loans help operators and their burgeoning brands scale, helping establish footholds in critical markets and consumer demographics.

It's critical to stand out as a cannabis brand. That isn't so much the case when seeking financing. Typically, lenders want just the facts about your business. Unless discussing your market differentiators, it's best to have a by-the-book application. Just give the lender what they're asking for, and you'll be set.

Both first-time applicants and existing operators often find success with a helping hand along the way. FundCanna's team of diligent experts is ready to provide your company with assistance along the way. And when ready to apply, you'll receive a response in as little as 24 hours.

FAQ's

Absolutely! Fundcanna provides access to capital to all cannabis businesses in the supply chain as well as all businesses that service the supply chain. Apply today!

Hemp companies have access to the full suite of financial products provided by FundCanna.

Hemp companies need to provide FundCanna 3 months' worth of bank statements, our simple application, and year-to-date financials. That's it.

In most cases, no. The majority of our financial solutions do not require any sort of collateral to get approved.

Invoice Financing

It can be hard to realize your dreams without the right team. FundCanna is in your corner. With FundCanna’s invoice financing, you can continue to invest in your business while maintaining cash flow. Don’t be at the mercy of other people’s payment cycles. Send us your invoices. We’ll send you 80% of the invoice amount. And upon payment, we’ll send you the remaining 20% (minus fees). It’s that easy!

Inventory Financing

You need supplies to meet your demands. Unfortunately, your clients aren’t always prompt with their payments. This isn’t just frustrating, it can slow your growth. Don’t let it. FundCanna’s inventory financing offers a solution. Upon approval, we will pay your vendors for the supplies you need, and when your clients finally come through, send us the full amount we paid, plus accrued financing fees. You only pay fees on the amount of funds you use, regardless of how much you’re approved for.

Inventory Financing

You need supplies to meet your demands. Unfortunately, your clients aren’t always prompt with their payments. This isn’t just frustrating, it can slow your growth. Don’t let it. FundCanna’s inventory financing offers a solution. Upon approval, we will pay your vendors for the supplies you need, and when your clients finally come through, send us the full amount we paid, plus accrued financing fees. You only pay fees on the amount of funds you use, regardless of how much you’re approved for.

Get the funding you need. FAST.

Approvals in as little as 24 hours

Follow Us

Explore

info@fundcanna.com