These Are the 13 States Consuming

the Most Cannabis Per Capita

(And How It Might Help Your Business)

US cannabis retail sales expect to generate $33.5 billion this year. By 2028, the market is forecasted to contribute approximately $170 billion annually to the national economy. Those figures and many more interesting datasets are compiled in Marijuana Business Daily’s 2023 Factbook.

Some of the more interesting data compiled includes state by state usage. Using a Gallup national survey on drug use, 13 states were identified as having 20% or more of its adult population (age 26 and older) consumed cannabis in the past year. These types of data points can help brands identify lucrative markets to enter.

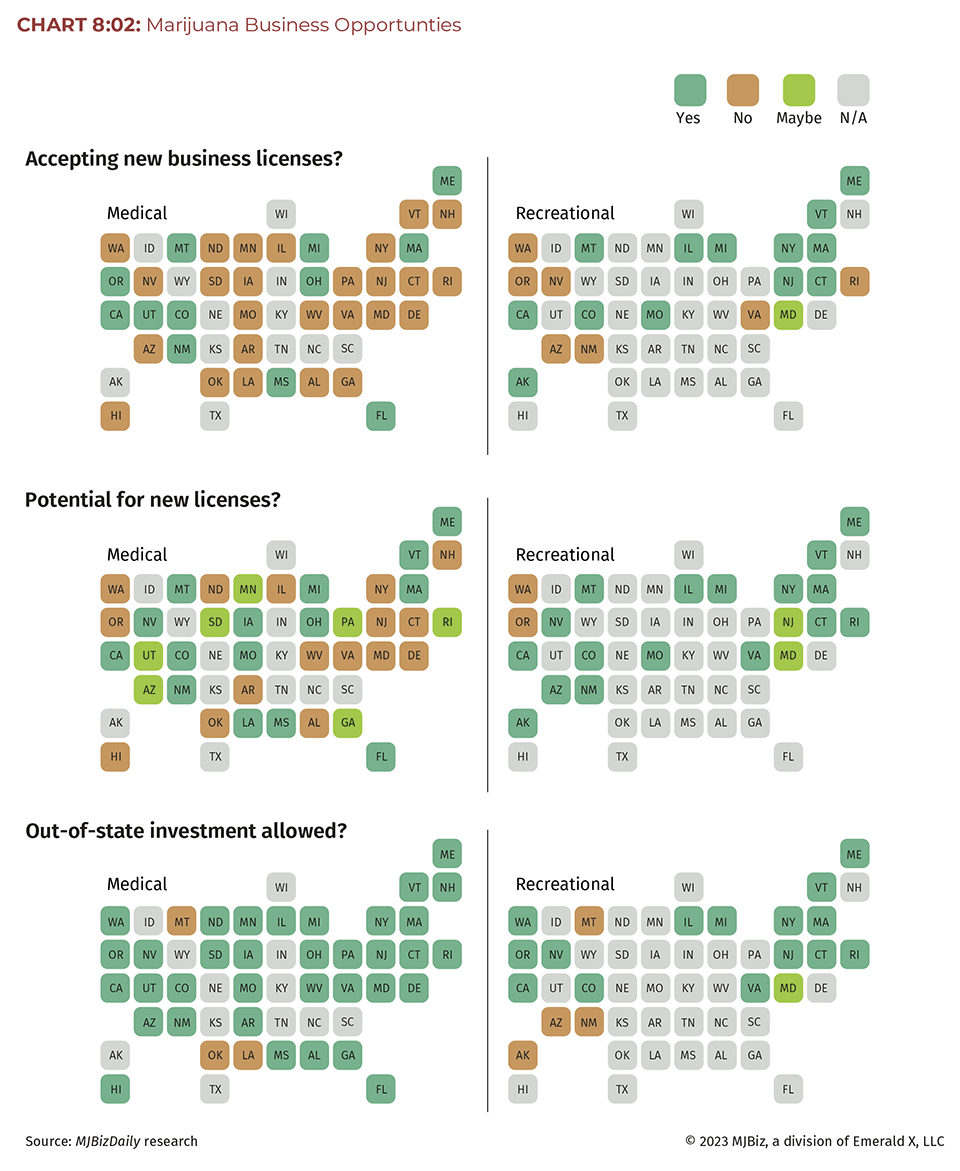

At the same time, various state regulations have created or blocked businesses from developing. Depending on the state, opportunities could be ripe for the taking, partially limited or even blocked all together.

While most of the nation appears in play, would-be entrepreneurs and investors must be aware of the potential and hurdles each market presents. Using the 13 states with the most adult consumers per capita, we can see that various scenarios are playing out nationwide.

Get the funding you need. FAST.

Approvals in as little as 24 hours

One of the two states to start blazing the trail for cannabis legalization in America, Washington State continues to develop. Residency requirements and social equity have been of primary focus as of late. In February, a US judge upheld the state's 6 month minimum residency requirement for ownership. The ruling ran counter to a decision in Maine may not long ago. Out of state investors looking to get involved in the market will instead have to follow state financier laws.

Social equity is in the spotlight as well. In May, a measure granted 52 retail licenses to those most affected by the drug war. Shops are slated to open between 2024 and 2032, marking a 10% increase from the current number of open shops. Ten cultivation and 100 processing licenses will also be made available, marking the first time either has been available since 2013.

Like many states on the list, including Oregon, Colorado, Michigan and Oklahoma, Washington suffers from oversupply issues. These factors often impact prices, market demand and allegedly help supply the US's illicit cannabis market.

Regulations and oversupply have long been a concern in Oregon. Boom and bust cycles have led to substantial price lumps and oversupply issues. By March 2023, per gram prices had reached a record low $4.

Often, proponents of interstate commerce cite Oregon as the perfect example for why it could benefit the market.

Oregon has undergone scrutiny regarding its cannabis laws, with an emphasis on creating a more equitable market through revised regulations. Additionally, cannabis businesses are facing additional consequences, with the state refusing to issue licenses to any brand owing back taxes.

Nevada did experience a decline in sales between mid-2021 and mid 2022, declining 3.8%, totaling $965 million. However the state looks as if it will be a strong market leader for many years to come. With a business friendly cannabis environment, investors can get a stake in the game.

The most exciting development as of late has to be the opening of cannabis consumption lounges. Nevada has allocated 40 licenses, with 10 designated for social equity applicants. The developments are positive after lawmakers eased regulations, leading to the issuance of the first lounge licenses. Shops are expected to open in the coming weeks.

In 2021, Alaska had the most competitive market based upon retailers per capita. By 2023, after seven years of operation, the market showed signs of slowing down. In recent years, businesses have faced tough times, leaving many brands to struggle or close.

Regulatory complexities continue to frustrate operators, particularly regarding access to traditional financing options. Taxes also present a problem, with Alaska's adult use taxes among the highest in the nation.

The recent hardships have not steered regulators from additional licensing. In 2022, state agencies were predicting that cannabis cultivation would create the largest job growth in Alaska between then and 2030.

Vermont began its adult use sales in December 2022, generating $2.6 million in revenue during the first month of business. Since then, the state has made promising strides with its retail market. The first 3 months saw the state open 25 stores.

The quick rollout of shops reportedly helped satisfy Vermont's hungry consumer demand. State regulators continue to monitor the situation as the market matures. Monitoring includes potentially capping new grower licenses in an effort to avoid access supply situations found in several other states.

Get the funding you need. FAST.

Approvals in as little as 24 hours

In 2022, one year before Washington state's verdict on its 6 month residency clause, Maine saw its similar residency laws deemed unconstitutional. The decision is already changing rules in the state. Meanwhile some have speculated that the ruling could set up future rulings regarding a critical cannabis industry component: interstate commerce.

Maine's market continues to surge ahead, with sales doubling in 2022, totaling $159 million in sales. Still, concerns surround a dwindling medical market, a common trend when states legalize adult use. Caregivers have left the market in mass waves while also railing against regulations related to required tobacco licenses and legal cannabis sales.

This past May saw Connecticut hitting a new adult use sales monthly high, with $11.5 million dollars generated. The figure marked a 13.2% increase from the month prior. Combined with medical sales, the state sold nearly $23 million during the period.

The positive numbers are joined by an ongoing evolution for the state. Initial lottery methods for licensing were being reconsidered in 2022 after facing a consolidated lawsuit brought forth by 11 applicants. Similarly, the state has had to reconsider some of its licensing application fees after lawsuits were filed. The process has generated the state at least $59 million dollars in fee-based revenue so far.

Meanwhile, lawmakers have set their sites on delta 8 THC products. The state also repealed a tax credit permit for cannabis operators. In May, a team of nearly 50 cultivators joined United Food and Commercial Workers Union (UFCW) Local 919, marking the first cannabis union.

All eyes have been on New York since the state first legalized the adult use market. Its commitment to social equity has slowed the rollout of licenses, leading to frustration among some consumers, investors and would-be operators.

However, licenses are now starting to roll out and stores are slowly coming online. Long Island is beginning to see its first shops open up. Meanwhile, the Finger Lakes region, one of the five districts held up in a licensing lawsuit, recently granted its seven allocated licenses.In May, an additional 50 licenses were approved, bringing the total to over 200 across the state.

In July, the state finally found an investor for its $200 million equity fund to help support equity operators. The state has also ramped up crackdown efforts on unlicensed retailers. Reports of raids have increased in recent months.

Michigan's cannabis market appears to be stabilizing after severe prices drops lead to some dispensaries selling $50 ounces. Prices haven't been the only concern, with corruption and debts in the spotlight.

Several regulators have been exposed in bribery scandals. Meanwhile, additional proposed regulations have taken aim at cannabis operators who fail to pay their vendors. If approved, the law would prohibit those with delinquent vendor bills from receiving licenses.

Regulations may be a headache for the state, but stabilizing retail prices has been a welcome relief. As has the news that the cannabis industry is sending $60 million to cities and counties with cannabis businesses.

Get the funding you need. FAST.

Approvals in as little as 24 hours

New Mexico began its adult use sales on April 1st, 2022. In that first year, the state exceeded $300 million in sales. Tourism played a significant part during the year, with many consumers traveling from neighboring Texas.

The strong sales numbers were supported by New Mexico's ability to mitigate supply challenges. Credit has been given to the state for allowing existing medical operators to take place in the adult use space. Additionally, the state was commended for increasing its plant count from roughly 1,700 plants per grow license to 20,000.

Despite the signs of promise, scores of regulators have their concerns surrounding new licenses and illicit market competition. In July, over 100 existing businesses and supporters urged lawmakers to place a temporary hold on new licenses so that regulators could first create market stability.

Along with Washington State, Colorado blazed the trail for adult use cannabis sales. Much has been learned in those years. The market has suffered from inclusion deficiencies in years past, and has been focused on changing course for some time.

All the while, the state is dealing with an array of struggles. They include sagging 420 sales, with some saying their numbers results were the lowest in five years. Meanwhile, allegations of lab test cheats continue to impact product credibility while giving some evidence to voice support for stricter regulations.

In early July, the state's cannabis enforcement division alerted the over 2,700 license businesses that their operational fees would be increasing by an average of 8%.

Oklahoma's wide open medical-market licensing plan created a state filled with businesses and biomass. Today, thousands of operators exist despite the state having less than 4 million people living in it.

To counter the oversaturation, the state passed a two-year licensing moratorium on new medical licenses, prohibiting the issuance of any new licenses until August 2024. The window was extended an additional 2 years in May 2023. Under the current rules, no new medical licenses can be issued in Oklahoma until August 1, 2026.

The state does not look like it will be expanding to recreational cannabis anytime soon. In March 2023, voters rejected a ballot initiative that would have expanded the scope of the law to adult use.

An Evolving Market Full of Opportunity

Each state presents their own unique hurdles and opportunities. That is the case for these 13 states, as well as others where adult consuming rates may not be as high among its adults.

No matter what state you plan to operate in, FundCanna is there for you. Contact us today to discover how cannabis industry financing can unlock a world of potential for your business.

Get the funding you need. FAST.

Approvals in as little as 24 hours

Follow Us

Explore

info@fundcanna.com