Cannabis Dispensary Loans

Don’t let cash flow slow your roll.

Keep your shelves stocked with FundCanna’s flexible and affordable financial solutions.

Good news, cannabis lovers! This is the best time ever to be an enthusiast.

Sure, marijuana is still illegal on the federal level, but decades of draconian laws are crumbling before our very eyes. We see it in the ever-growing number of states that are legalizing marijuana — not just for medical use, but for good old recreational fun!

It’s as if a wave of common sense is sweeping across the country, and in its wake, countless cannabis companies are springing forth. Take dispensaries, for instance. Long gone are the days of buying pot brownies in parking lots.

You now have access to a dazzling array of elevating goods, all of which are lab-tested for potency and purity.

Want an absolutely delicious edible with exactly 2.5mg of a high-quality hybrid THC? You got it.

Craving a refreshing CBD beverage? You have options.

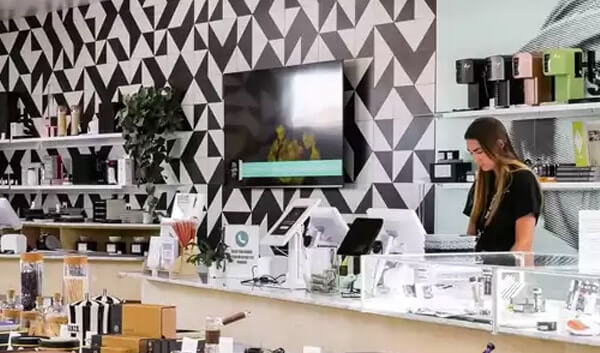

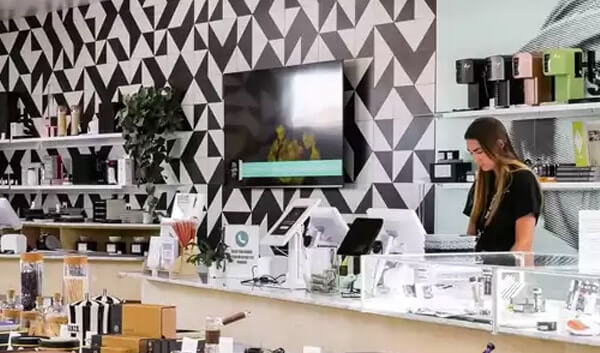

A great dispensary captures the imagination. It inspires awe. Step into a great one and you’re bound to feel like a kid in a candy store.

All the best dispensaries have one thing in common — lots of awesome inventory. And therein lies the rub.

You need a lot of working capital to operate a dispensary.

It can be difficult to find a line of credit. Traditional financial institutions aren’t offering cannabis companies many financing solutions. Marijuana businesses don’t have the same access to financing options as, say, their peers in beer. That’s where we come in.

FundCanna is the leading provider of cannabis funding for a reason. Not only do we have the experience and resources you need, we love this industry and want to see every last link of the supply chain succeed and flourish. Especially dispensaries like yours!

We take pride in providing a wide variety of financing solutions to dispensaries: cash advances, equipment financing, commercial real estate loans, and more. We will help you secure the working capital and cash flow you need to keep your shop stocked with eye-popping inventory that will keep your customers coming back.

Don’t let cash flow slow your roll.

Keep your shelves stocked with FundCanna’s flexible and affordable financial solutions.

Good news, cannabis lovers! This is the best time ever to be an enthusiast.

Sure, marijuana is still illegal on the federal level, but decades of draconian laws are crumbling before our very eyes. We see it in the ever-growing number of states that are legalizing marijuana — not just for medical use, but for good old recreational fun!

It’s as if a wave of common sense is sweeping across the country, and in its wake, countless cannabis companies are springing forth. Take dispensaries, for instance. Long gone are the days of buying pot brownies in parking lots.

You now have access to a dazzling array of elevating goods, all of which are lab-tested for potency and purity.

Want an absolutely delicious edible with exactly 2.5mg of a high-quality hybrid THC? You got it.

Craving a refreshing CBD beverage? You have options.

A great dispensary captures the imagination. It inspires awe. Step into a great one and you’re bound to feel like a kid in a candy store.

All the best dispensaries have one thing in common — lots of awesome inventory. And therein lies the rub.

You need a lot of working capital to operate a dispensary.

It can be difficult to find a line of credit. Traditional financial institutions aren’t offering cannabis companies many financing solutions. Marijuana businesses don’t have the same access to financing options as, say, their peers in beer. That’s where we come in.

FundCanna is the leading lender in the cannabis space for a reason. Not only do we have the experience and resources you need, we love this industry and want to see every last link of the supply chain sparkle and shine. Especially dispensaries like yours!

We take pride in providing a wide variety of financing solutions to dispensaries: cash advances, equipment financing, commercial real estate loans, and more. We will help you secure the working capital and cash flow you need to keep your shop stocked with eye-popping inventory that will keep your customers coming back.

Applying for a Cannabis Dispensary Loan has never been easier.

Fill out the form below and have access to the capital you need in as little as 24 hours.

Explore if our Dispensary Financing solution is right for you

How a Cannabis Dispensary Loan works

Cannabis Dispensary requests Working Capital from FundCanna to cover payroll and purchase more products to fill their shelves.

Cannabis Dispensary submits documents to FundCanna. FundCanna pays Cannabis Dispensary within 24 hours.

Cannabis Dispensary now has the necessary funds to pay their staff and order additional products.

Cannabis Dispensary makes payments to FundCanna and pays off their loan with favorable terms.

How a Cannabis Dispensary Loan works

Cannabis Dispensary requests Working Capital from FundCanna to cover payroll and purchase more products to fill their shelves.

Cannabis Dispensary submits documents to FundCanna. FundCanna pays Cannabis Dispensary within 24 hours.

Cannabis Dispensary now has the necessary funds to pay their staff and order additional products.

Cannabis Dispensary makes payments to FundCanna and pays off their loan with favorable terms.

Cannabis Dispensary Financing FAQ's

You may need between $250,000 to $5,000,000 to open a cannabis dispensary. The number can grow even more in certain markets. Unfortunately, since cannabis is still banned at the federal level, banks and traditional funding institutions aren’t eager to provide funding for cannabis businesses. They don’t want to risk any possible prosecution due to financing a cannabis dispensary.

The lenders that decide to finance you often charge sky-high interest rates since they deem the cannabis industry a risk. Other institutions may require collateral or a higher down payment when funding your cannabis dispensary, fearing similar risks.

All the best dispensaries have one thing in common — lots of awesome inventory. And therein lies the rub.

You need a lot of working capital to operate a dispensary.

It can be difficult to find a line of credit. Traditional financial institutions aren’t offering cannabis companies many financing solutions. Marijuana businesses don’t have the same access to financing options as, say, their peers in beer. That’s where we come in.

FundCanna is the leading provider of cannabis funding for a reason. Not only do we have the experience and resources you need, we love this industry and want to see every last link of the supply chain succeed and flourish. Especially dispensaries like yours!

Additional Dispensary Problems Created By Federal Regulations

Financing isn’t the only issue dispensary operators must contend with. Federal regulations create a myriad of difficult hurdles, including:

Most Operate In Cash Only

As mentioned, although a few cannabis businesses accept debit or cryptocurrency, cannabis is a predominantly cash industry.

This model leaves cannabis dispensaries vulnerable to break-ins and robberies, as everyone knows the cash-intensive industry holds its cash on-site or with a third-party provider.

There’s also the risk of money disappearing while in transit. It’s common for a cannabis distributor or cultivator to send their drivers from point A to B to deliver products and then return with thousands of dollars–in CASH. Thieves are aware, amplifying industry concerns. Examples include a man allegedly stealing at least $145,000 from a van in Santa Ana in 2020.

Cannabis dispensaries also need someone to count the cash, make money drops, earmark money for taxes and other expenses, obtain money orders, etc. This scenario can increase the risk of theft and misappropriation, as reports indicate that 90% of money and product losses in the cannabis industry are due to employee theft.

Cannabis Dispensaries Can’t Make Standard Business Deductions

Usually, businesses can deduct company expenses such as wages, rent, equipment, supplies, etc. However, it’s different for cannabis businesses.

According to section 280E of the Internal Revenue Code, businesses dealing with federally controlled substances such as cannabis can’t deduct any production, distribution and sale expenses.

The regulation makes it more expensive to run a cannabis dispensary compared to any licensed non-cannabis business. Here are some of the expenses that a cannabis dispensary can’t deduct on their business tax return which other traditional companies can:

- Contract labor

- Equipment purchase/repair

- Insurance

- Inventory cost

- Licenses and fees

- Professional fees

- Rent

- Salaries

- Salaries

- Storage

- Utilities

A cannabis dispensary can still deduct the cost of goods sold (COGS), which refers to all direct production costs, including cannabis purchases and travel. Be careful when deciding what to include in COGS. If the IRS comes knocking, they will likely scrutinize thoroughly.

How FundCanna’s Cannabis Dispensary Financing Can Help

Opening and running a successful cannabis dispensary is a costly affair.

First, there’s the expensive application process for licenses, with some states requiring upward of $4,000 for retail licensing.

Some large distributors pay up to $100,000 for their annual licensing!

You will also need to acquire space for your business, hire qualified staff, buy inventory, pay for security, market your brand, and still have enough working capital to fund your dispensary's daily operations.

As we’ve already established, traditional financial institutions and banks won’t typically finance a cannabusiness operation as long as the federal government considers marijuana a Schedule 1 substance.

So where will you get the working capital you need to stock your dispensary, buy inventory, etc.?

Here’s where we come in as FundCanna. We have a wide range of flexible funding solutions for cannabis dispensaries, including:

Working Capital gives you enough financial wiggle room to grow and expand your cannabis dispensary.

With our flexible Working Capital funding solution, you’re cushioned against unexpected or seasonal downtime with enough money to pay your suppliers and subcontractors, launch a marketing campaign, pay employees, and still take advantage of any available inventory discounts.

Our Vendor Financing solution helps free up the cash flow you need to expand. Suppose you want to purchase new trucks for delivery, lease cannabis equipment or buy raw materials for your cannabis dispensary.

Say you need to purchase a new delivery truck. All you have to do is to contact FundCanna. Once you’re approved, we’ll pay the entire invoice amount in as little as 24 hours.

At FundCanna, we want to be the bridge that

helps your cannabis dispensary get to the other side.

We are passionate about all links in the cannabis industry. We believe every qualified cannabis dispensary should have access to adequate and flexible funding solutions to attain its goals and vision.

Here’s how to get the money you need in less than 48 hours:

- Apply For Funding:

A cannabis brand requests working capital from FundCanna to cover payroll, purchase inventory, buy equipment, etc. - Submit the Necessary Documents:

As you fill out our online application form, you’ll be asked to submit vital information about your dispensary. - Get Approval

Our team will approve your application in as little as 24 hours. Once approved, you can expect money within 24 hours. - Make Payment to FundCanna

Pay FundCanna back using favorable terms agreed upon before the start of your loan.Which funding solution do you need? Contact FundCanna for expert advice!

Get the funding you need. FAST.

Approvals in as little as 24 hours

Follow Us

Explore

info@fundcanna.com