The Hidden Cost of Using Your Own Cash:

How Liquidity Turns Margin Into Growth

Sam thought he was doing the smart thing. He’d been running his dispensary for years, and every cycle he funded his own orders.

No lenders, no fees, no strings attached.

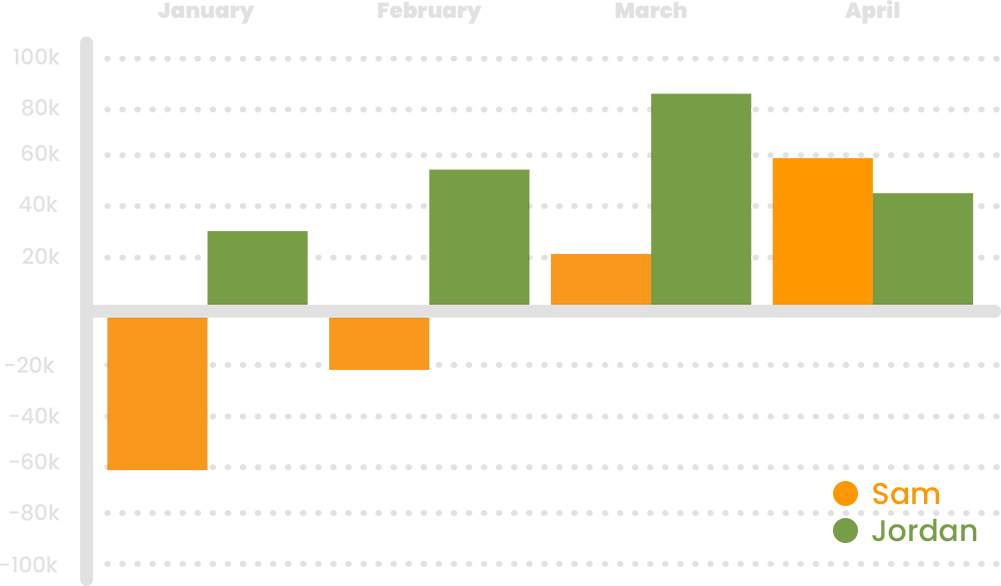

In January, Sam shelled out $100,000 of his own working capital to restock shelves. Over the next four months, he cleared $60,000 in profit.

Margins looked strong. But there was a catch: his $100K was locked up for months.

When payroll hit in February, he dipped into personal reserves. When a vendor offered a bulk-buy discount in March, he couldn’t touch it.

On paper, the numbers looked fine. In practice, he had no room to move.

That’s the hidden cost of self-funding: it takes away your flexibility.

Liquidity = YES Money

Across town, Jordan is running a business identical to Sam’s.

Same shelves, same customers, same margins.

In January, he also needed $100,000 to stock up. But instead of draining his own reserves, he borrowed the capital.

Same shelves, same revenue: $160,000.

After paying for capital, his profit was $48,000, smaller than Sam’s $60,000.

But here’s the thing: Jordan kept his $100,000 on hand. He had the liquidity advantage.

Liquidity isn’t just safer, it unlocks growth.

Sam, who fronted the cost of goods, is underwater until mid-March, when he finally breaks even on his $100K investment.

Jordan never dips into the red. He’s cash flow positive from Day 1, making small weekly payments as product moves — and in Month 4, he repays in full. (It’s a strategic move: with FundCanna’s no-penalty early repayment, he decides exactly how much his capital costs.)

Liquidity didn’t just keep Jordan out of the red, it gave him momentum.

Net Cash Position - Sam vs. Jordan

And he put that liquidity to work.

In March, he jumped on the supplier discount Sam had to pass on, locking in better margins for the next cycle.

Payroll in February wasn’t a scramble.

Most importantly, he invested $42,000 back into his business.

Jordan’s reinvestment wasn’t random. He launched a loyalty program, revamped the store experience, and put money into targeted digital ads.

He partnered with a local delivery app to capture first-time buyers and trained staff to turn them into repeat customers.

By the end of the year, his active customer base had grown by 25%. Those customers turned faster, bought more often, and pushed him from three inventory turns to four.

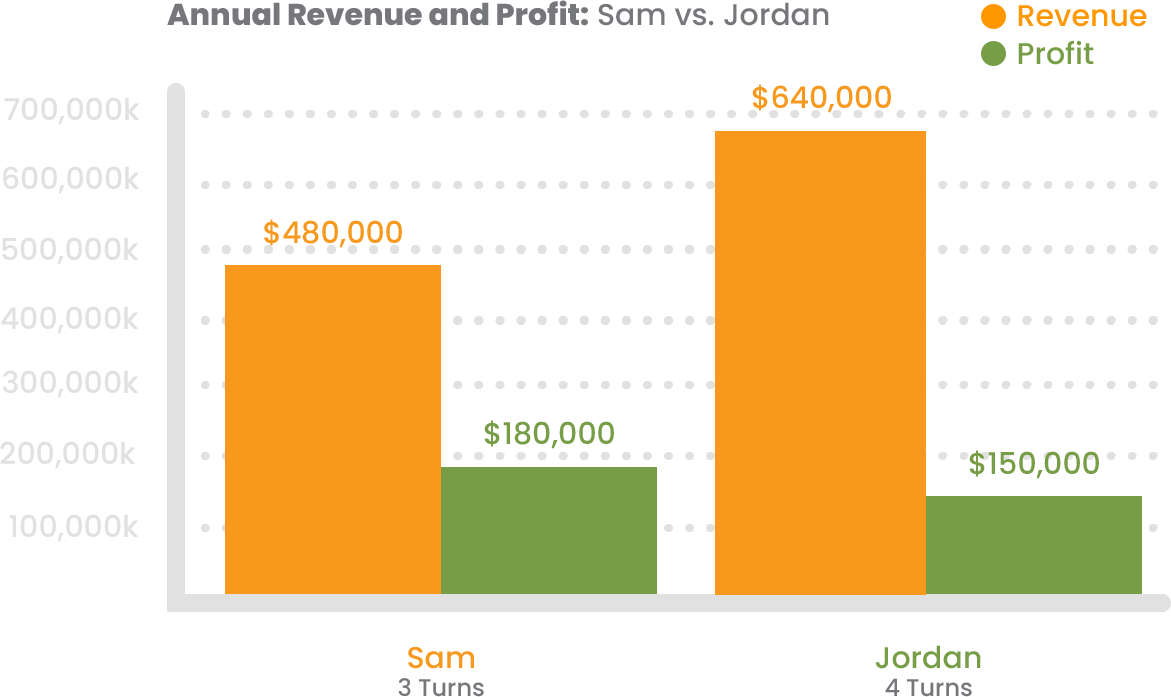

The Year-One Math

0

TURNSSam (Self-Funder)

Revenue: $480K

COGS: $300K

Profit: $180K

Growth: Flat

0

TURNSJordan (Borrower + $42K growth reinvestment)

Revenue: $640K

COGS: $400K

Cost of Capital: $48K

Marketing & Tech Investment: $42K

Profit: $150K

Growth: 25%

Average Quarterly Bank Balance = ~30% higher than Sam’s

Jordan ended the year with a stronger cash position, higher revenue, and a 25% bigger customer base to build on.

Here’s where things get really interesting.

Sam’s growth hit a ceiling: three turns a year, no new demand, and no cash cushion.

Jordan bought something far more valuable: momentum. He turned four cycles instead of three, ended with more customers, and kept his own cash liquid the entire time.

Jordan’s liquidity is what unlocks growth: more customers, more sales cycles, a stronger balance sheet.

Going into Year Two, he starts ahead — bigger base, stronger bank balance, and room to say yes when opportunity knocks. His growth engine doesn’t reset, it compounds. Jordan is now positioned to outpace Sam in revenue, profit, and scale year after year.

Liquidity gave him the power to reinvest, expand, and accelerate. Sam, meanwhile, is stuck in neutral.

The Takeaway

Sam relied only on margin. Jordan paired his margin with liquidity.

And that momentum multiplied his growth.

Download the Smart Operator’s Guide to Short-Term Capital to see even more real-world scenarios and understand the hidden costs of using your own cash.

Real strategies. Real ROI. Real growth.

This guide gives you the frameworks, examples, and real ROI math to help you use capital the way top operators do: strategically and profitably.

Get the working capital you need. Fast.

Approvals in as little as 24 hours

More From Our Blog

Follow Us

Explore

info@fundcanna.com

Follow Us

Explore

info@fundcanna.com