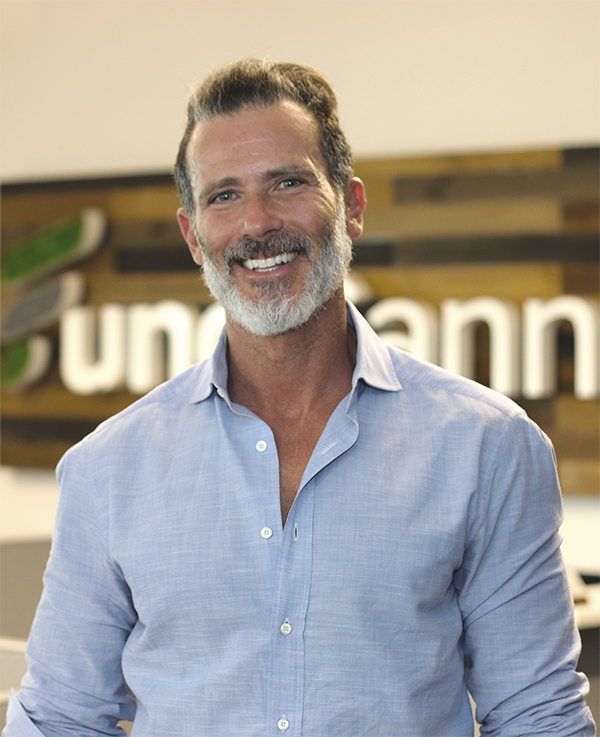

According to FundCanna's Adam Stettner, cannabis companies have a lower default rate than mainstream businesses.

Written by John Schroyer - Green Market Report

Despite recent media focus on various U.S. cannabis markets being in decline and lamentations of marijuana business failures galore, San Diego-based Adam Stettner, the CEO of FundCanna, said he actually sees a quite “healthy” industry with many companies performing well despite the innumerable obstacles they face.

Or, perhaps more accurately, Stettner said the situation is more akin to “a broken industry with a lot of healthy businesses within it,” given the industry’s federal tax burdens and other systemic hurdles not faced by traditional mainstream businesses.

Stettner, a longtime financial professional and business lender, said his assessment is based on one simple bottom-line fact: His firm, which in three years has approved roughly $287 million in loans to almost 2,000 cannabis loan applicants all across the country, has seen a default rate of slightly more than 2% in that timeframe.

Stettner compared that to his pre-cannabis days, when he spent 20 years working on consumer and commercial loans in the traditional lending business. There he helped obtain funding for about 150,000 companies – which returned a default rate of between 6% and 11%.

In other words, Stettner sees a lot of small and mid-sized businesses that are surviving, and in some cases thriving, in direct contrast to much of the media narrative about a distressed U.S. marijuana industry. But many of those aren’t getting the attention because splashy stories about operators like High Times and MedMen Enterprises imploding overshadow them.

“For every MedMen, there are probably literally thousands of dispensaries that are still chugging along, but they’re invisible to most of us, because they’re doing their thing and they’re not in the news for blowing up,” Stettner said. “Nobody is covering the person that owns three locations in central Michigan and is growing year-over-year. It’s not leaps and bounds, but they have a business and it’s doing well.”

Based on a review of company financials, many of the business are “surviving, and in some cases, they’re doing quite well,” he said.

“We’re underwriting healthy businesses that are finding a way to survive in an inhospitable environment,” Stettner said.

These companies are working against hurdles such as the 280E tax provision and the inability to get economies of scale due to interstate commerce restrictions.

The takeaway for Stettner is that in reality, a lot of companies are actually much better-positioned than many industry talking heads would assert, particularly given that it appears the U.S. federal government is poised to reschedule marijuana. That would nullify 280E and deliver hundreds of millions of dollars in tax savings to cannabis businesses.

In addition, a boom-and-bust cycle was likely inevitable, Stettner said, noting that the marijuana industry is not immune to the rules of economics. That means that some level of contraction was always in the cards, and parts of the U.S. cannabis industry are undergoing that now.

“Within the first year of operating, at least 20% of businesses fail. That has nothing to do with cannabis. And in less than five years, over 50% of small businesses fail. If we go out to 10 years, 70% of businesses fail,” Stettner pointed out. “If those are the stats, we can’t be surprised when we hear about closures.”

Stettner added, “When I look at this (industry), the resiliency and survival rate is as good as any other … I am insanely impressed at what has been achieved here, and the level of perseverance and follow-through.”

What that strength and adaptability means, particularly for small to medium-sized companies, is that when 280E disappears, “it’ll be like a cinder block being lifted off your chest.”

“It doesn’t feel like success for a lot of these operators” thus far, Stettner acknowledged. “But in reality, considering what they’re up against, man, if we just remove a couple of these barriers and they’re able to get a bit more stride, I think it’s going to be shocking as to how far it takes people.”

Get the working capital you need. Fast.

Approvals in as little as 24 hours

More From Our Blog

Follow Us

Explore

info@fundcanna.com